VISTmany

VISTmany Vistmany@gmail.com

Telegram

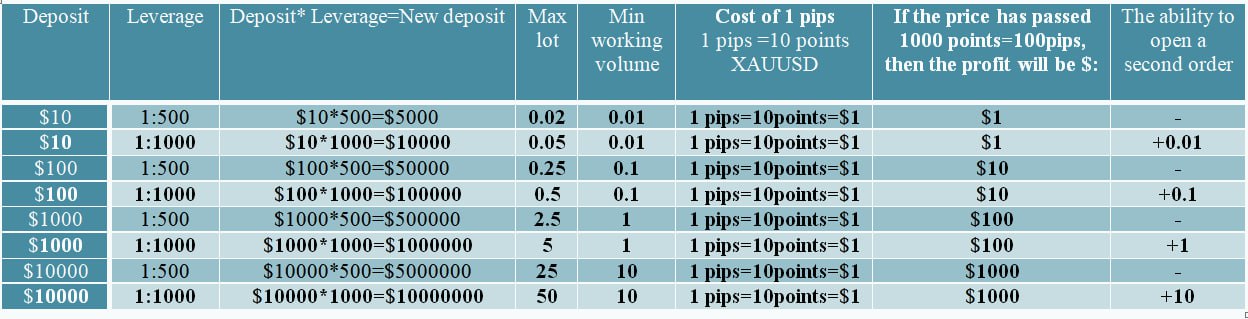

Each broker provides the trader with the opportunity to use leverage. The trader decides on his own whether to use this opportunity or not. In the table, let's look at how leverage "increases" your deposit. With the help of different deposit values, let's look at the change in the value of the opening volume of an order or orders. For scalping, the shoulder plays a big role. Especially if the trader has a small capital. Leverage means additional opportunities, but also additional risks for your capital. Use this tool responsibly in your trading.

XAUUSD. One contract for a pair of XAUUSD is 100 troy ounces (1 lot=100 troy ounces). 1 ounce of gold is equal to approximately 31.1035 grams. But we need to determine the price of 1 lot XAUUSD in dollars. To do this, you need to multiply 100 troy ounces by the current price of the XAUUSD pair: 1 ounce = $1970 (current gold rate), 100 t.o.*$1970 = $197000, that is, 1 lot = $197000.

Why do we need the amount of one contract (1 lot) for XAUUSD? If we know the amount of 1 contract (lot) in dollars ($197,000), then we can calculate what maximum lot volume we can apply in the process of trading (scalping), having a certain capital.

Example 1. Calculation of the maximum volume with a deposit of $ 1000 (without leverage) looks like this: $ 1000:$197000 = 0.005 lot. But the minimum lot that can be opened is 0.01. The minimum leverage of 1:10 will help here. Then our deposit needs to be multiplied by 10. Instead of $1000, we now have $10000, which gives us the opportunity to find out the maximum lot of 0.05.

After that, we choose a volume that is comfortable for us, taking into account the risks. The working lot can still be divided into parts so that it is possible to open a network of orders. Example 2. You opened buy 0.01 lot, but the price of the timing level went down a little more. Then you open another buy order. After that, you average the profit. We will definitely consider the topic of averaging orders in the near future.