A short description of the VISTmany project forecasting system

iVISTscalp5 Prediction Indicator is the main innovative product of our project. We are interested in everything related to time. iVISTscalp5 can be called a "Time Machine". The iVISTscalp5 indicator is presented on the website with default parameters (optimal settings) and for the MetaTrader 5 trading terminal (here the parameters can be any and more than 125 financial instruments). iVISTscalp5 searches for the highest probability of a pulse in the time interval that you have set for it. The pulse time and direction are displayed as flags at the bottom of the chart for the whole week ahead. Magic! The indicator does a huge part of the trader's work. Time was invented by people for convenience and synchronization of actions. Therefore, we used our time to the fullest for trading. Let's introduce the concept of "timing".

Timing is a forecast of the most likely price movement (sell or buy) at a given time. Each timing additionally contains a forecast of the average take profit that a trader can receive. Forecasts have the power of timing, which gives it priority. Timing is the time level where there is the highest probability (90-95%) of making a profit. The algorithm of trading using the VISTmany forecast system is quite simple: on the chart of any financial instrument, we see the forecast time, make a decision whether to open an order or ignore the timing. The process of self-learning is to learn how to make a decision, use a forecast or skip. There are more than 20 timings per day on only one financial instrument. You can always find the best 3-4 forecasts, earn money, rest the rest of the time, or switch to other things. No need to strive to trade all forecasts! Always strive for quality, not quantity.

Timings work schedule:

from 03-00 to 19-00 (winter time UTC+2)from 04-00 to 20-00 (winter time UTC+3)

When to ignore timings? (working with the iVISTscalp5 indicator)

(The information is recommended especially for novice traders)

Our goal is to teach you how to make a profit on timings. Timing is a forecast of time and a forecast of the potential of the average price movement of a financial instrument for scalping. The forecasting system is embedded in an indicator (manual trading) and a trading advisor (algorithmic trading). The most effective timings are in UTC: from 03:00 to 19:00 (winter time), from 04:00 to 20:00 (summer time).

1. If the price is at the minimum of the day or week, we ignore the sell timing. If the price is at the maximum of the day or week, ignore the buy timing.

2. If the timing forecast contains a small number of points/pips, it is better for novice traders to ignore these timings. A small movement may not pay off the broker's commission and spread.

3. We know the forecast of timings for the week ahead. It always helps to do the analysis. The location of timings is very important. If we see the sell timing, and after it, according to the forecast, you see a range of buy timings (from 2 or more), it is better to ignore the sell timing. Similarly, ignore the buy timing if you see a continuous range of sell timings ahead according to the forecast.

4. If there was sufficient growth before the buy timing, ignores the buy timing. The best signal to enter the buy timing is when the price has been falling before that time. It is the same with the sell timing. It is best when there was growth in front of him. Always remember that we have a scalping system. This means that we take a small part of the price movement that our system predicts. If you have no experience in trading, follow the rules of the system clearly.

5. If the price in the iVISTscalp5 indicator is on balance (pink circle), it is better to refrain and not trade.

6. We do not trade on the first Friday of the month. On this day, the important news is Non-Farm. When the news about the US GDP comes out, we recommend not trading on timings. This news is usually released at the end of each month (Thursday, sometimes Wednesday).

7. On the third Thursday and Friday of the month, do not trade according to timings. The days of monthly expirations make adjustments to the market, which can lead to a loss of capital.

8. If, according to the forecast of our system, you see double timings, for example, buy, then it is better to ignore the sell timings before them. If we see double sell timings ahead, then we ignore the buy timings ahead of them.

SELF-STUDY PLAN and description of the scalping system by time

Our forecast is your profit! If you are reading the article, it means that your self-learning process has already begun. Congratulations! Now discipline should be your middle name. The main thing is to learn how to analyze and make the right decisions. The first thing you should do is to learn the basic rules of the forecasting and scalping system.

The iVISTscalp5 indicator forecast system answers two important questions for a trader:

1. At what time to open an order for scalping.

2. What is the average profit you can get for this timing (forecast).

Additional advantages of the iVISTscalp5 indicator:

The VISTmany forecast system is a universal tool for making money on the Forex market or on other trading platforms.

1. You know the forecast for each instrument for the week ahead. It remains to assess the situation and make a decision on opening an order. Making a decision is exactly what you need to learn.

2. The VISTmany forecasting system relieves the psychological stress of the trader.

3. Comfortable analysis without haste. The indicator can be used with default settings for all financial instruments.

4. The iVISTscalp5 indicator is an endless laboratory for the trader. Everyone can adjust the indicator so that the work is as comfortable and efficient as possible.

5. The iVISTscalp5 indicator is a ready-made business. Especially if you already have a large audience on social media.

6. The iVISTscalp5 indicator can be used for binary options.

7. If the sell timing with a large movement forecast is at a minimum, ignore the timing. At the maximum, ignore buy.

8. The forecasting system embedded in the iVISTscalp5 indicator can be a good addition to your trading strategy.

What do you need to figure out on your own?

1. If you do not have the iVISTscalp5 indicator (the indicator automatically detects the time of your trading terminal), then you need to correctly determine the time of your trading terminal. I would like to draw your attention once again, not the time in your country, but the time of the trading terminal. Often these two events do not coincide. You can see how to determine the time correctly here.

2. The time of the most important news of the economic calendar should be written out on your desk a week in advance. The schedule of the largest exchanges and the expiration days of options and futures are also important.

3. Independently take into account your broker's commission and spread. If the timing forecast shows a small number of points/pips (1 pips=10 points), ignore the timing. If you open an order based on such a forecast, you may receive a loss. This is a very important point!

4. Consider the risks yourself. This is entirely your responsibility.

5. It is mandatory to study and follow all the rules of the forecasting system.

VISTmany scalping according to time forecasts

The forecast is calculated for the week ahead for any financial instrument (more than 125) in the mt5 terminal.

The indicator currently calculates forecasts for 12 financial instruments on the website.

Gradually, new trading tools will be added to the site.

Our goal is to provide information and tools for self-learning in order to form your thinking and understanding of scalping by timings. Answer the questions.

Your goal: to take information and learn how to trade according to the forecasts of the iVISTscalp5 indicator, to make a profit on an ongoing basis.

1. Choose discipline, independence, consistency and training.

2. You study the basic concepts of the forecasting system in the timing school.

3. From the first day, you start trading according to the rules of the forecasting system on a demo account in mt5.

4. If there is no broker, you can register here.

5. Choose one financial instrument. You study the operation of timings and trade forecasts on it. Then you can use a lot of tools in your work.

6. To quickly understand how timings work, regularly test the iVISTscalp5 indicator. It doesn't cost you anything, but you get a visualization of the scalping forecast process. Additionally, you study the main levels of the iVISTscalp5 indicator. And also see how the forecasting system works. And how the forecasts of our system are fulfilled.

7. Watch the video of trading by timings (forecasts) on our YouTube channel.

8. Double timings - these are the first assistants of novice traders. Learn how to work with them.

9. Study the dynamics of the price of a financial instrument when the iVISTscalp5 indicator forecast consists only of sell or buy timings in a row. An analysis of this process can be done in the mt5 strategy tester.

10. Observe how the price of a financial instrument moves from timing to timing. How the price tests the previous time levels (timings).

11. Ignore timings that have a small forecast for profit. Remember that our forecast for profit is an average value. Therefore, always set a profit less than stated in the forecast. If possible, transfer the order to breakeven.

Human greed and his stinginess of mind are the causes of failures in the world of trading

Constant development, training, research and discipline are the qualities of a trader that will lead to stunning success! A scalper is a trader who feels the breath of the price of a financial instrument. This quality of thinking and reading the market comes in the process of systematic learning and practice. Our iVISTscalp5 indicator does a huge part of the scalper's work. A trader needs to learn how to make a disciplined decision in order to make a profit. To do this, you need to strictly follow the rules of our VISTmany forecasting system, constantly learn how to trade using the forecast system and constantly test the iVISTscalp5 indicator at the first stage.

Official contacts of the VISTmany project:

Website: https://vistmany.com/Telegram: https://t.me/vistmany

Telegram chat: https://t.me/vistchat

Timings School: https://t.me/scalpvist

YouTube: https://www.youtube.com/@vistmany557

Twitter: https://twitter.com/rosy440

Twitter: https://twitter.com/iVISTscalp5

Email: Vistmany@gmail.com

Examples of trading by timings

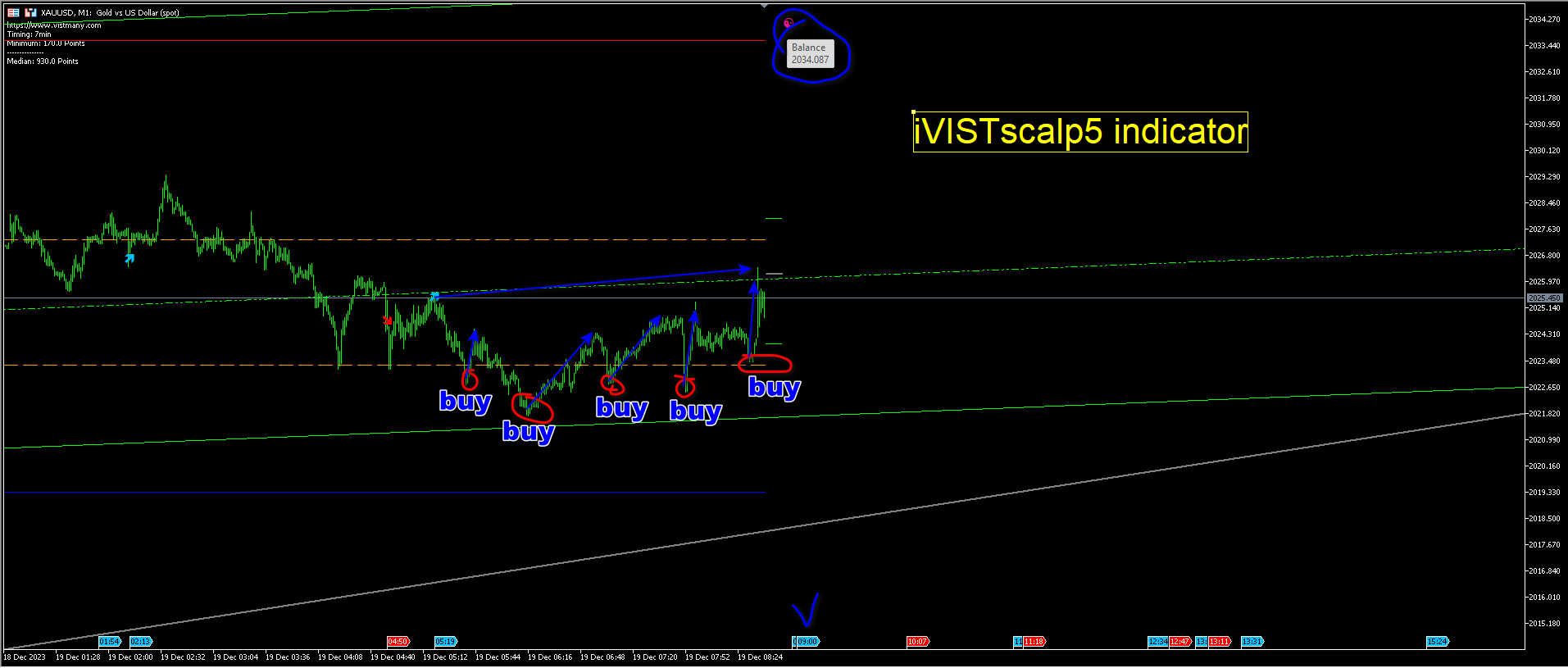

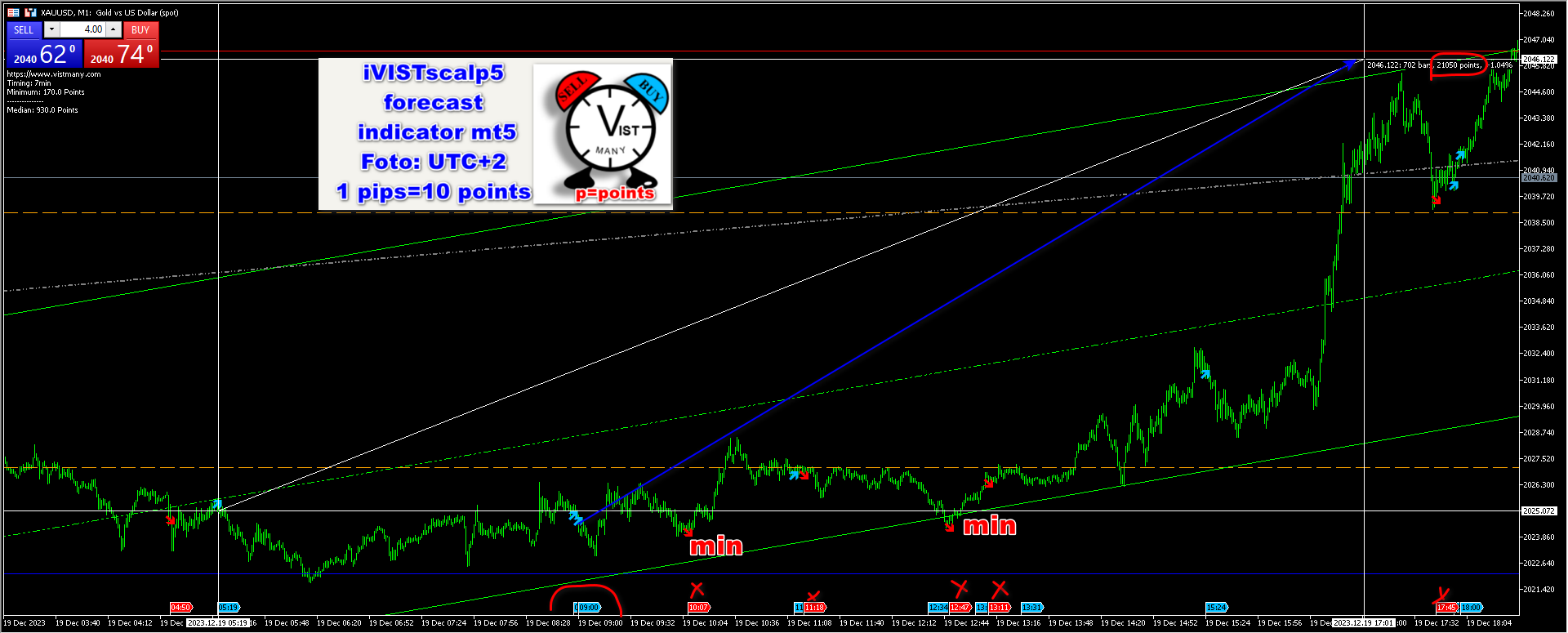

Example 1.

Analysis and description of the trading situation on 12/19/2023. Buy timing 05:19 XAUUSD

Let's look at an example where we analyze the situation on XAUUSD on 12/19/2023. We use the iVISTscalp5 indicator for trading. In order to learn how to work with our VISTmany forecasting system, learn the rules of our scalping system. There is a decision-making procedure for opening an order by timing - it is +3 minutes. The VISTmany forecasting system is the key time levels where the moods of the big players in the financial market are clearly expressed.

Let's consider one of the basic rules:

1) If the price increased before the buy timing, we ignore the buy timing.

2) If the price decreases before the sell timing, we ignore the sell timing.

This is a simple rule of the scalping system by time levels. Many traders do not take into account the rules. This is a big mistake. Our forecasting system is scalping. That is, we take profit on a small price movement. If there was an increase of, for example, 2500 points/250 pips before the buy timing, and our forecast for the buy timing is 900 points/90 pips, it makes no sense to open a buy order at the time indicated in the forecast. Why? Because there is a high probability that the price will decrease to the nearest level. It is from this level that you can open the buy timing, if there is analytical confirmation for this. But the best option for novice traders is to ignore the buy timing if there was growth before it. Similarly, if there was a price drop before the sell timing.

General analysis of the XAUUSD pair. Why is buy timing relevant in this situation?

1. The price at the time of the buy 05:19 timing is close to the minimum of the daily channel. In such cases, the price is likely to test the minimum or break through it. Therefore, the input for this timing must be carried out from the channel boundary. If the price is flat, then you can open a buy order several times in the vicinity of the timing. We just need to remember that we are scalping. You should have quick deals. You do not need to hold orders for a long time, especially if you still have the experience of a novice trader.

2. Ahead we see double buy timings (08:57-09:00). This gives us confirmation that it is possible to open a buy order using XAUUSD. Double timings most often show the main direction of the price.

3. In the iVISTscalp5 indicator, we calculated the price balance. There is a pink circle on the chart. Balance is a magnet where the price tends to return. In our situation, the balance is far at the top. This is another confirmation for gold purchases at the moment.

4. The price in our forecasting paradigm moves from timing to timing, that is, from one time/price level to the second time/price level. Two timings are highlighted in the photo (shown by arrows) – sell 04:50 and buy 05:19. The price level at the onset of the sell timing 04:50 -2024.905 , the price level at the onset of the buy timing 05:19 – 2025.600.

The basic rules of trading on the VISTmany forecasting system

1. Discipline is the foundation of a trader!!! We go by timing and take into account the main price levels. VISTmany forecasting systems are presented in three products: on our website, in the iVISTscalp5 indicator (the MetaTrader 5 trading terminal) and the ScalpAuT trading advisor (the MetaTrader 5 trading terminal). If you want to quickly master trading according to time forecasts, be sure to test the iVISTscalp5 indicator a lot in the mt5 terminal strategy tester (MetaTrader 5).

2. On our VISTmany website, timings are indicated by red and blue circles. The points/pips forecast for timings on the site is presented in the form of red (sell) and blue (buy) histograms under the graph.

3. The red flag in the iVISTscalp5 indicator (the MetaTrader 5 trading terminal) is the sell timing forecast. The blue flag is buy. The forecast of the timing and movement strength (points/pips) is located inside each timing. You need to move the mouse over the timing to get the information.

4. The forecast of timings in the iVISTscalp5 indicator is calculated for the week ahead. Before opening a trading order, we must analyze the timings that were previously available. We are conducting an analysis of forecasts that are ahead of time. We evaluate the forecast based on a combination of timings.

5. Remember that our system is a quick deal. Usually (the probability of forecasts is +95%) during the timing, an impulse occurs, according to which we should get a profit and close the deal. If you have trading experience, then you can hold the trade to get the desired profit. It is better for novice traders to follow the rules of the system clearly.

6. One of the basic rules of our forecasting system is not to open a sell timing order at the minimum of the day (at the minimum of the daily or weekly channels). Do not open a buy timing order at the maximum of the day (at the maximum of the daily or weekly channels). The iVISTscalp5 indicator has all the necessary price levels and channels for effective analysis and trading. If you do not use our iVISTscalp5 indicator, then plot all the necessary levels and channels on the chart yourself.

7. One more important rule can be highlighted: if there was a drop in the price of a financial instrument before the sell timing, we ignore this forecast. If there was a price increase before the buy timing, we ignore this forecast. In such cases, you can do something else. If there was a drop in the price of a financial instrument before the sell timing, it is according to this time forecast that we do not open an order. We are waiting for the nearest upper price level and only then open the sale. We do the same if there was a price increase before the buy timing. We are waiting for the nearest lower price level of a financial instrument and only after that we open a purchase. The only exception is paragraph 6. The iVISTscalp5 indicator has all the necessary levels for the scalper to work effectively.

8. The most effective trading weeks are 2 and 3.

9. Analysis of the forecast by the number of points/pips in each timing (the number of pips / points can act as a take profit). You determine the stop loss yourself.

10. Analysis of the nearest levels and trend lines of the iVISTscalp5 indicator.

11. Double timings are timings that differ from 2 to 6 minutes. For example, buy 17:11 and buy 17:15. Their time difference is 4 minutes. Another example, sell 14:30 and sell 14:36. The time difference is 6 minutes. These are examples of double timings. If the first forecast of the two has worked, we ignore the second timing. (https://t.me/scalpvist/432) Quite often, double timings indicate that there will be momentum in their direction in the near future. Keep an eye on the main price levels and channels. Consider the power of timings. It is important not to trade on double buy timings at the maximum of the day (or at the maximum of the daily and weekly channels). We ignore the double sell timings at the minimum of the day (or at the minimum of the daily and weekly channels). Otherwise, in such cases, you can do as described in paragraph 7 of this article. The only exception is paragraph 6. You always need practice and training on a demo account. Don't ignore the practice process. This is very important for developing scalping skills.

12. Consider the range of timings (3-5 timings in a row of the same color). Consecutive forecasts in red or blue (sell timings are a red flag, buy timings are a blue flag in the iVISTscalp5 indicator) tell us that there will be an impulse towards timings. Most often, such situations occur before important news. The price has been flat for a long time, and on the news, the entire range of timings of the same color works out in one pulse. We know all the forecasts for the week ahead, so use a cluster of timings of the same color for analysis to make the right decisions. At the same time, we must remember the rule written in paragraph 6.

13. It's time for the main news. Quarterly expirations.

14. The opening and closing time of the exchanges (At this time, take into account not only the timings, but also the main price levels). Do not trade during clearing.

15. Monthly expiration dates (Do not trade every third Thursday of the trading week. Usually, after this day on Friday, it is also better to refrain from trading on timings).

16. Before important news, the price is often flat. Timings are not partially fulfilled. Keep a close eye on the market before the most important news. If the timings do not work, it means that we expect a big spike in volatility ahead, while all timings will be worked out. Evaluate price levels, not just time levels, in order not to wait a long time for the timing forecast to be fulfilled. Take a profit according to the forecast two times less than the indicator calculated.

Let's make a small conclusion. You can always trade according to the forecasts of the VISTmany system. This requires knowledge and practice. Test the iVISTscalp5 indicator. Analyze and record key situations of a combination of forecasts. Patience and sustainability in development! Good luck to all and profit!