VISTmany

VISTmany Vistmany@gmail.com

Telegram

VISTmany

VISTmany Vistmany@gmail.com

Telegram

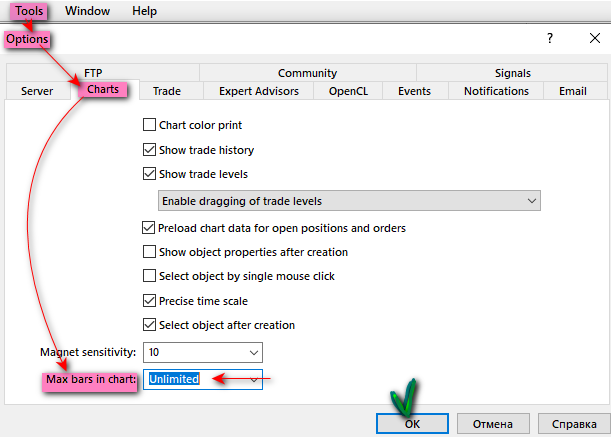

The procedure for installing the iVISTscalp5 indicator in the MT5 terminal:

1. Tools--Options--Charts--Max bars in chart: Unlimited

2. After that, close the mt5 terminal window. We do this to update the mt5 settings.

3. Start the mt5 terminal again.

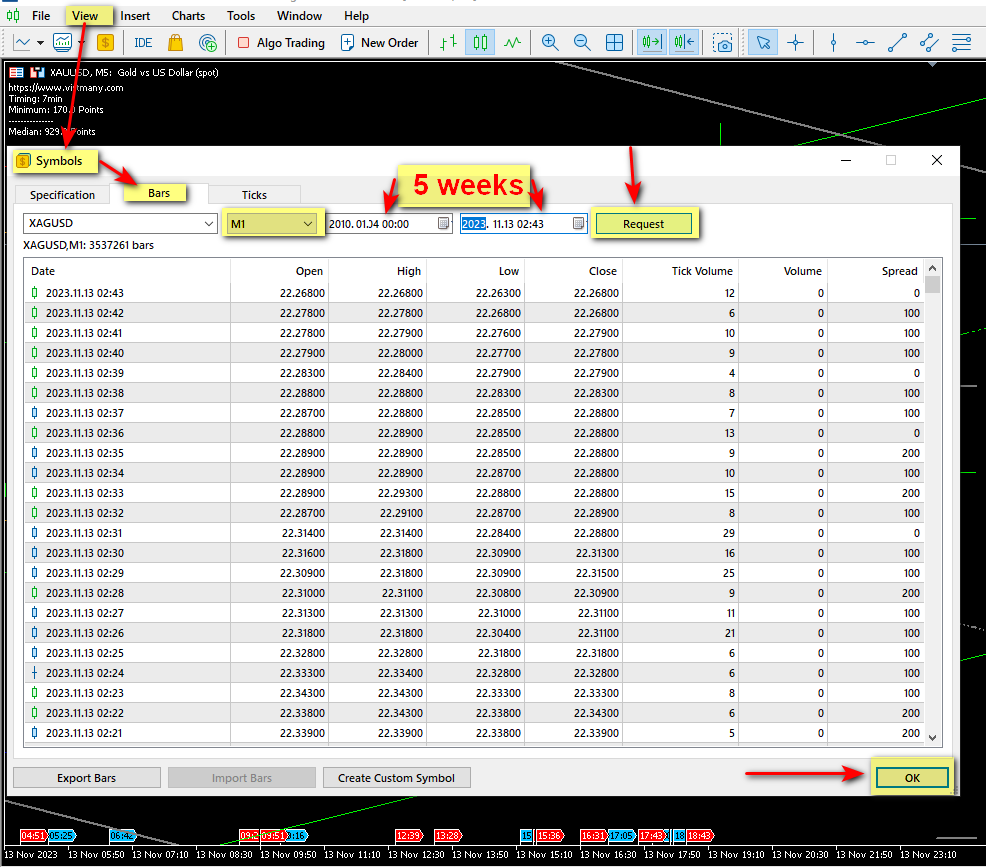

4.View--Symbols--XAUUSD--Bars(M1)--

5.View--Symbols--XAUUSD--Ticks (All ticks)--

6. Put the iVISTscalp5 indicator in the MQL--Indicators folder

7. After that, close the mt5 terminal window. We do this to update the mt5 settings.

8. Start the mt5 terminal again.

9. Opening the XAUUSD graph on a 1 minute time frame. We remove everything superfluous from the chart: the grid, tick volumes. We leave a clean schedule.

10. Drag the indicator to the chart on the timeframe of 1 minute. Ready!

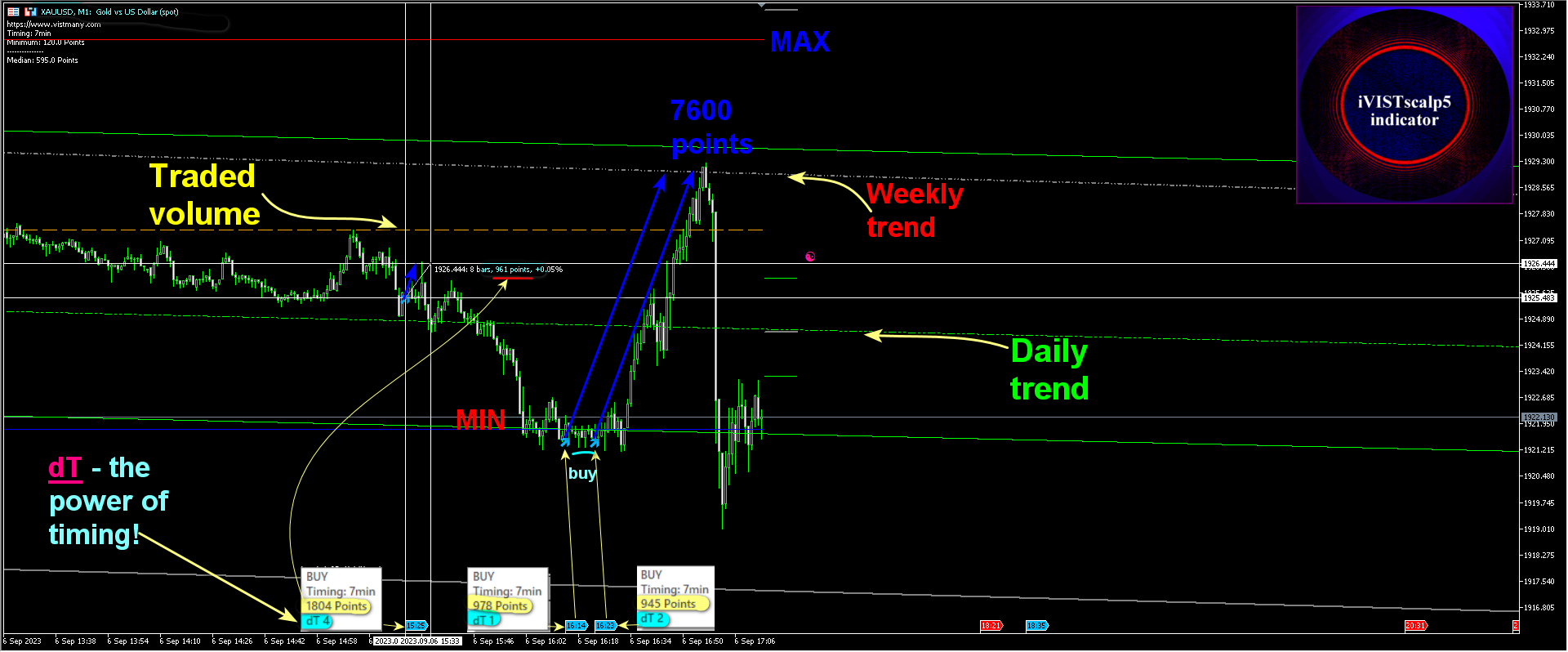

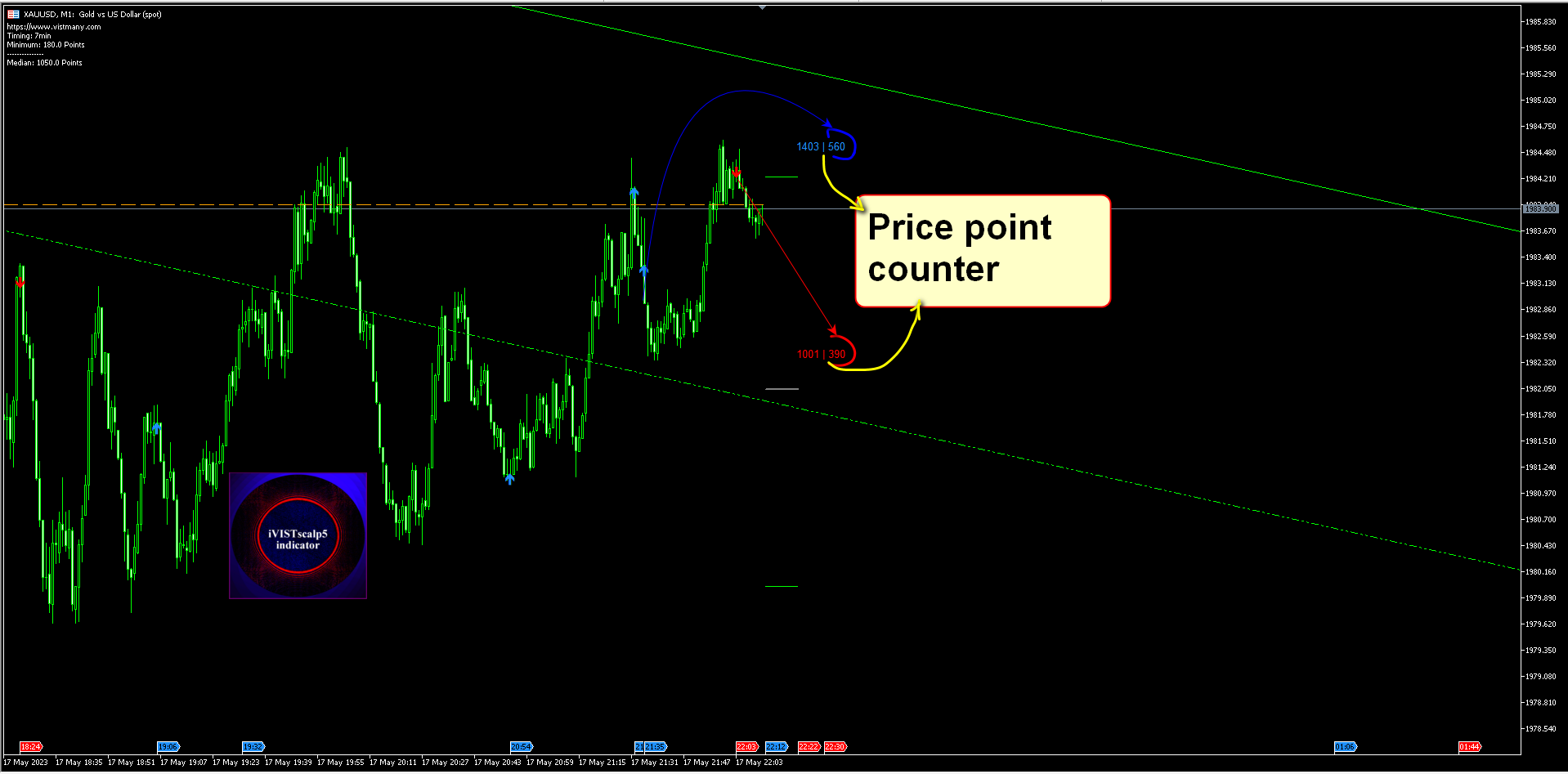

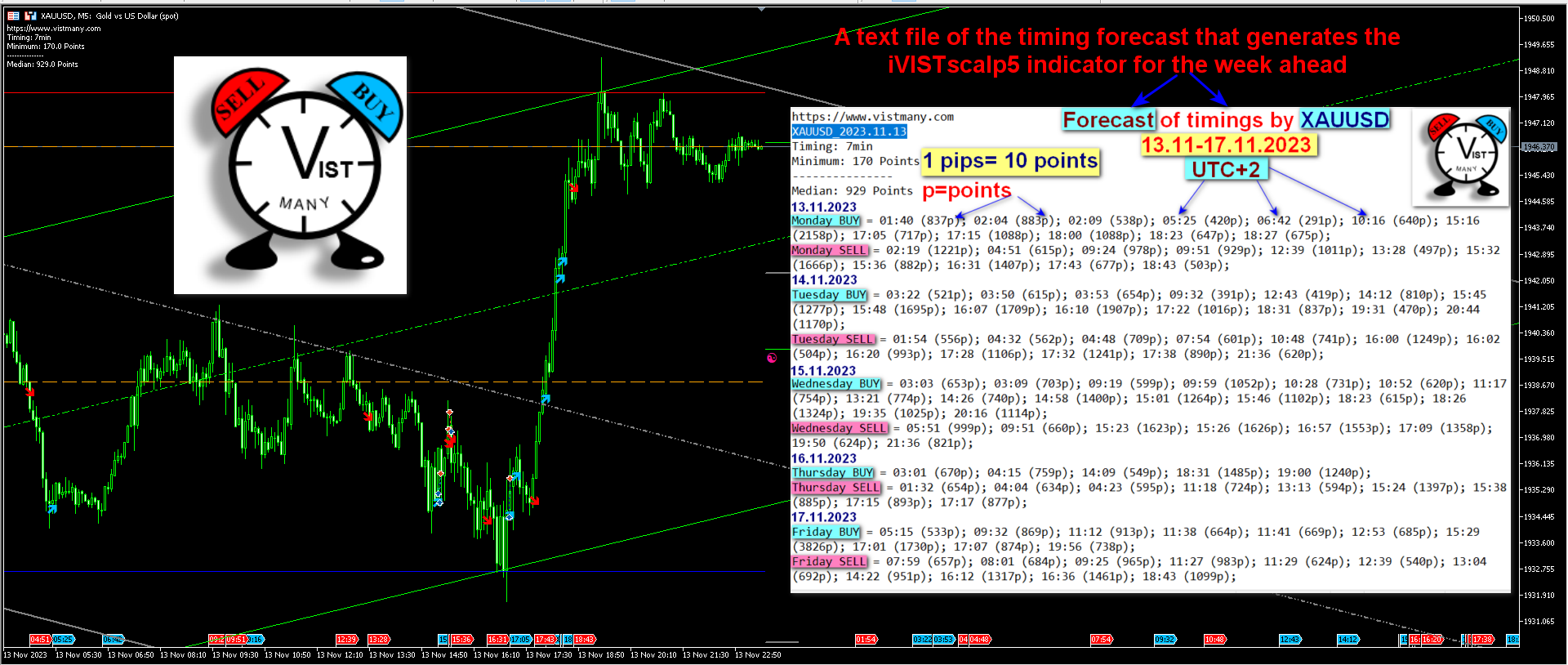

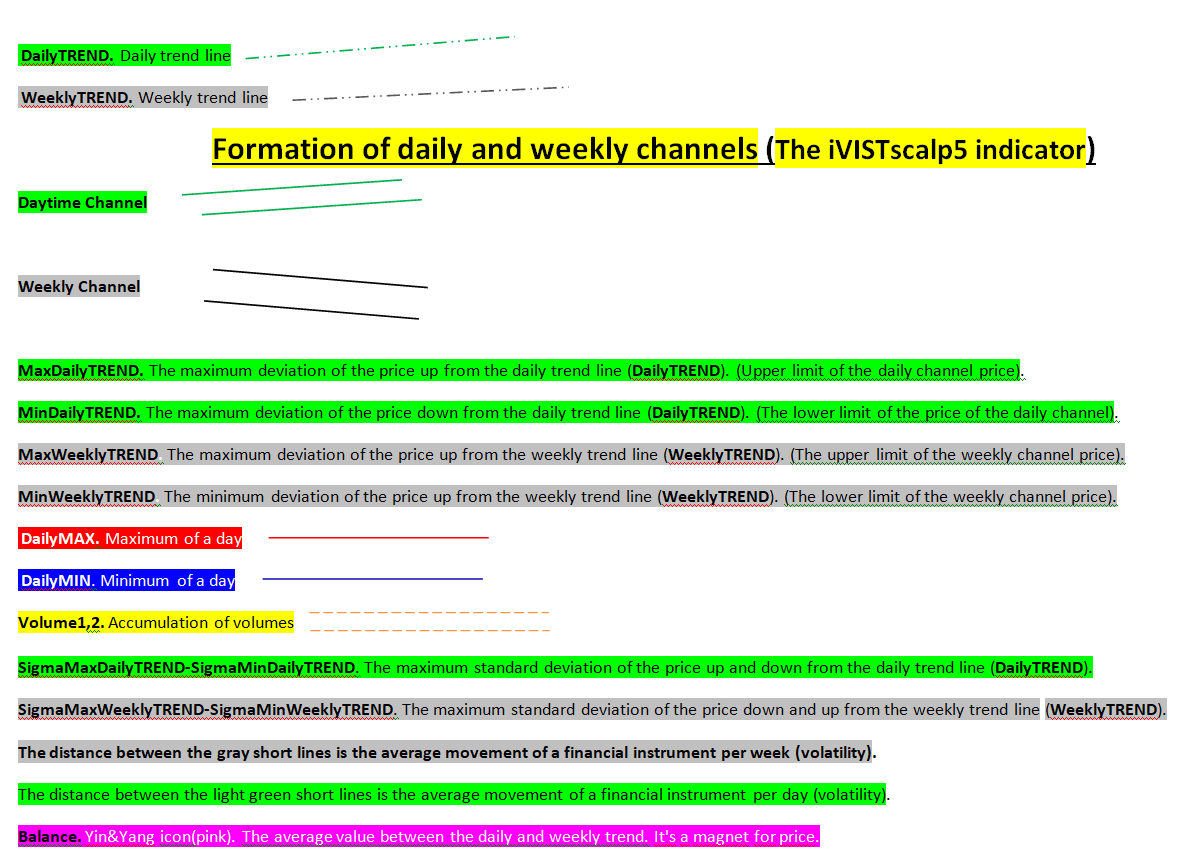

Now let's look at what the levels called SigmaMax WeeklyTREND and SigmaMin WeeklyTREND mean.

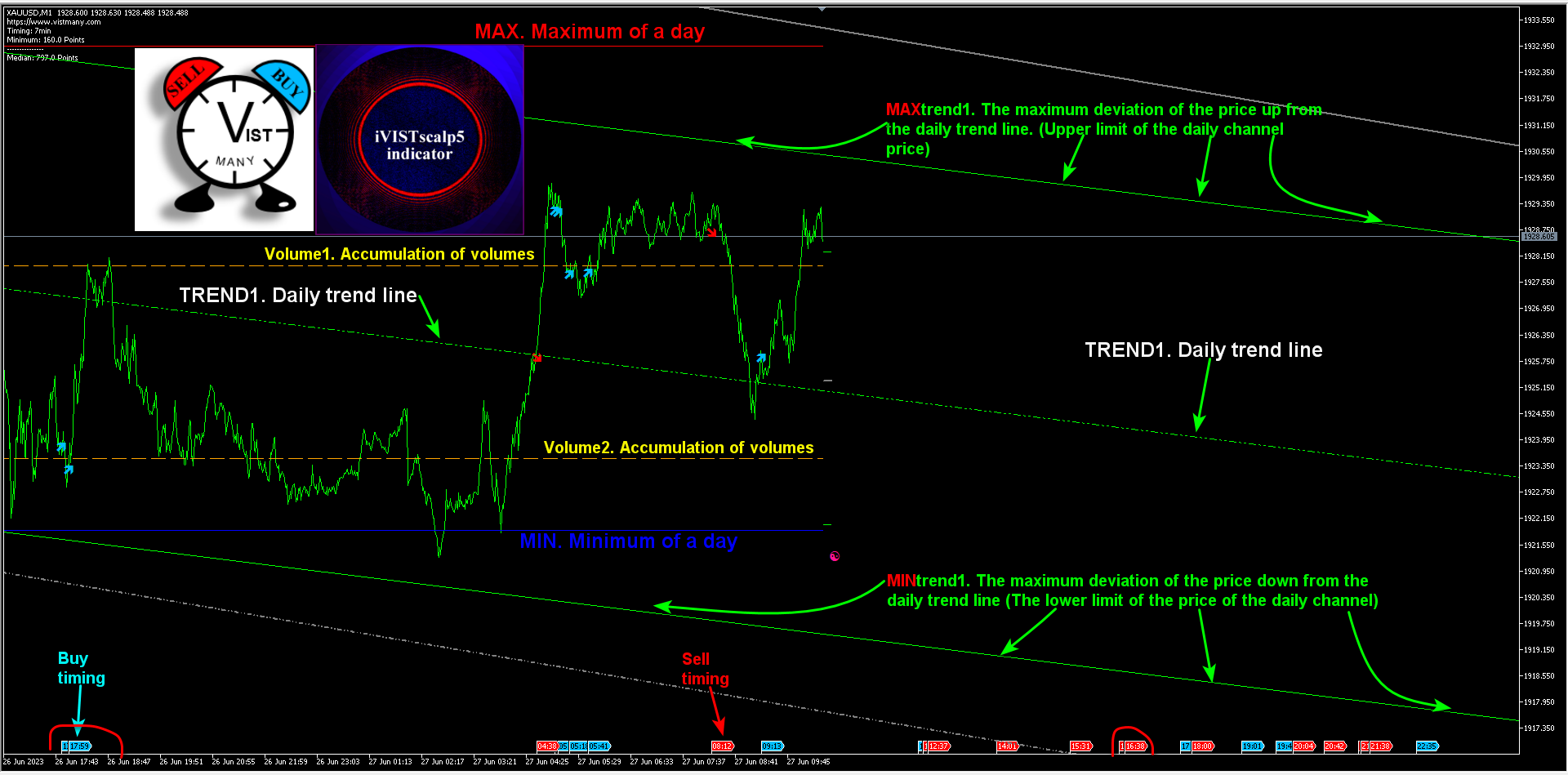

The maximum standard deviation of the price down and up from the weekly trend line (WeeklyTREND) is SigmaMax and SigmaMin. In another way, we can say that the distance between these gray levels is the average price movement for the week (volatility). If we go beyond the boundaries of the SigmaMax and SigmaMin levels, this is a zone of uncertainty. Very often at such moments, the price can update its extremes. Either there will be a new monthly (or weekly) maximum or minimum. Such moments are often called overbought or oversold by traders of the instrument.

Now let's look at what the levels called SigmaMax WeeklyTREND and SigmaMin WeeklyTREND mean.

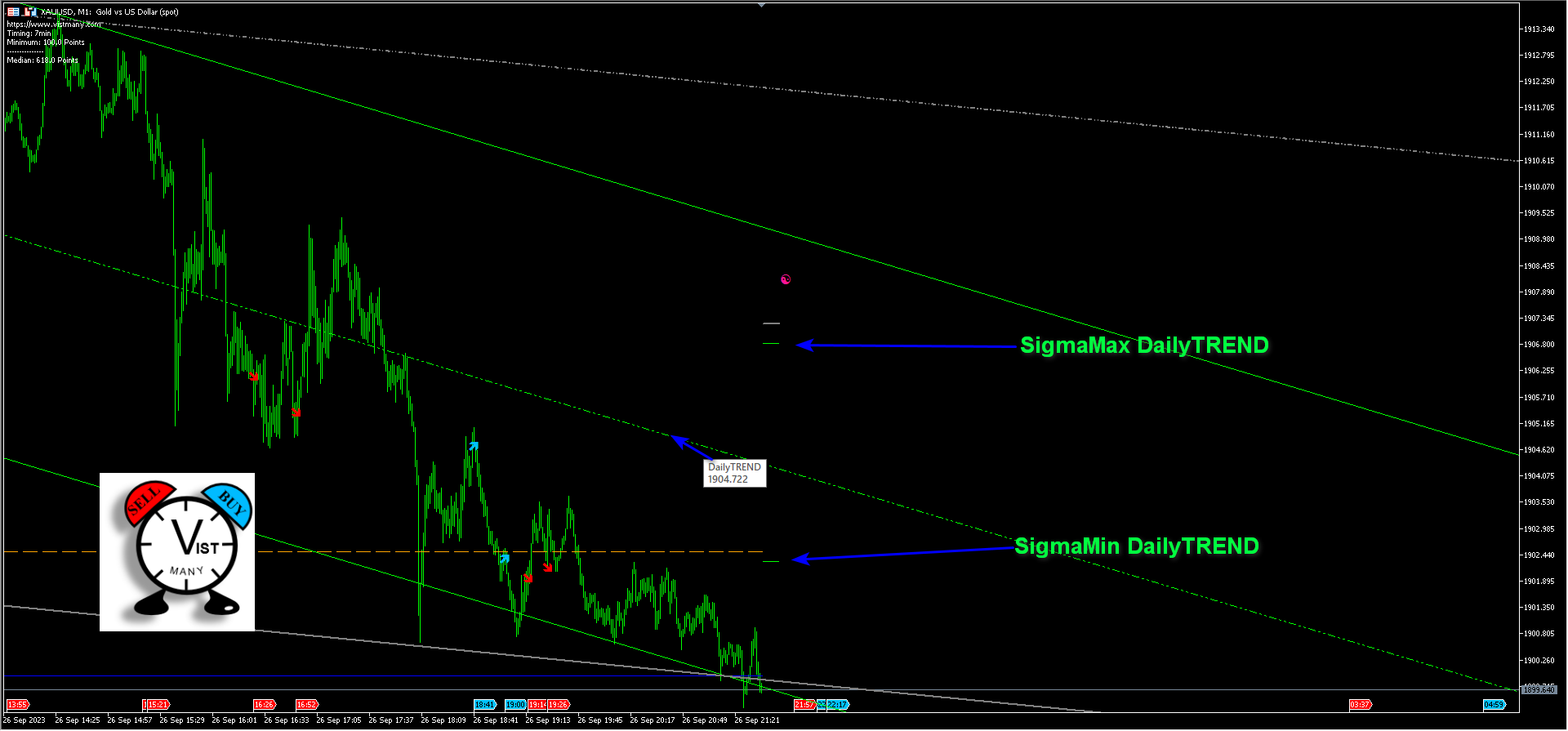

The maximum standard deviation of the price down and up from the weekly trend line (WeeklyTREND) is SigmaMax and SigmaMin. In another way, we can say that the distance between these gray levels is the average price movement for the week (volatility). If we go beyond the boundaries of the SigmaMax and SigmaMin levels, this is a zone of uncertainty. Very often at such moments, the price can update its extremes. Either there will be a new monthly (or weekly) maximum or minimum. Such moments are often called overbought or oversold by traders of the instrument. By analogy with SigmaMax WeeklyTREND and SigmaMin WeeklyTREND, there is also a daily channel and a daily trend. The daily trend (DailyTREND) has the maximum standard deviation of the price down (SigmaMinDailyTREND) and up (SigmaMax DailyTREND) from the daily trend line. The daily trend on the chart is indicated by a light green dashed line.

By analogy with SigmaMax WeeklyTREND and SigmaMin WeeklyTREND, there is also a daily channel and a daily trend. The daily trend (DailyTREND) has the maximum standard deviation of the price down (SigmaMinDailyTREND) and up (SigmaMax DailyTREND) from the daily trend line. The daily trend on the chart is indicated by a light green dashed line.

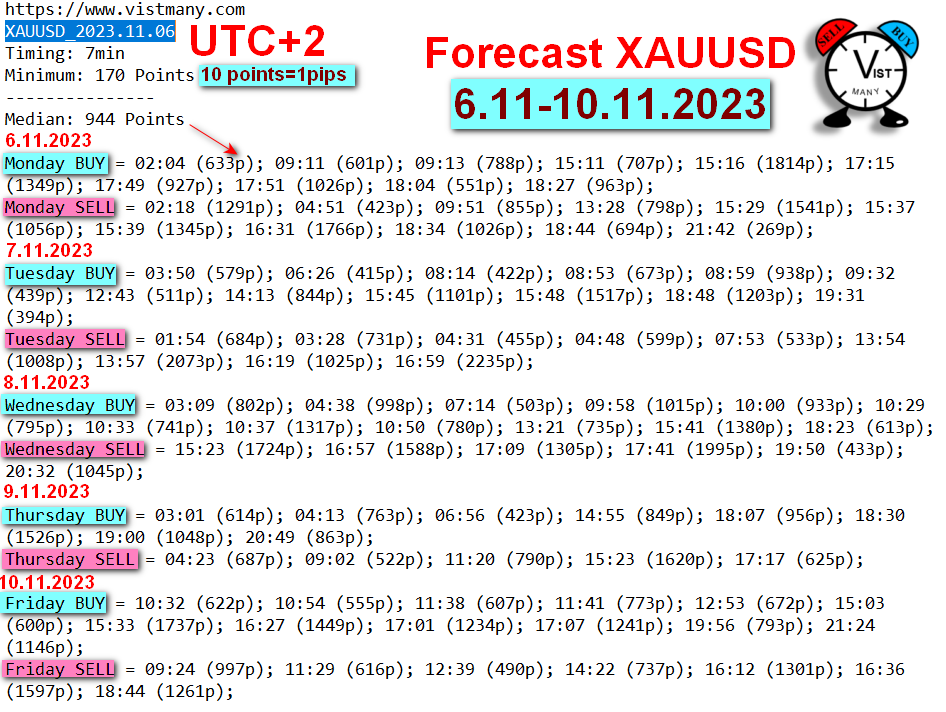

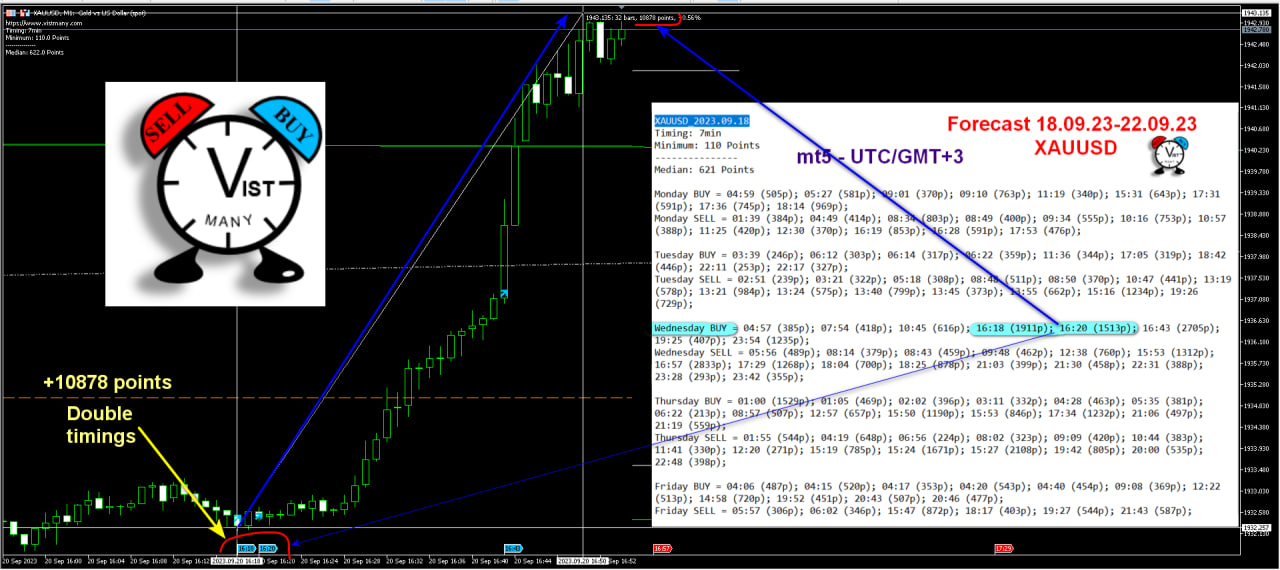

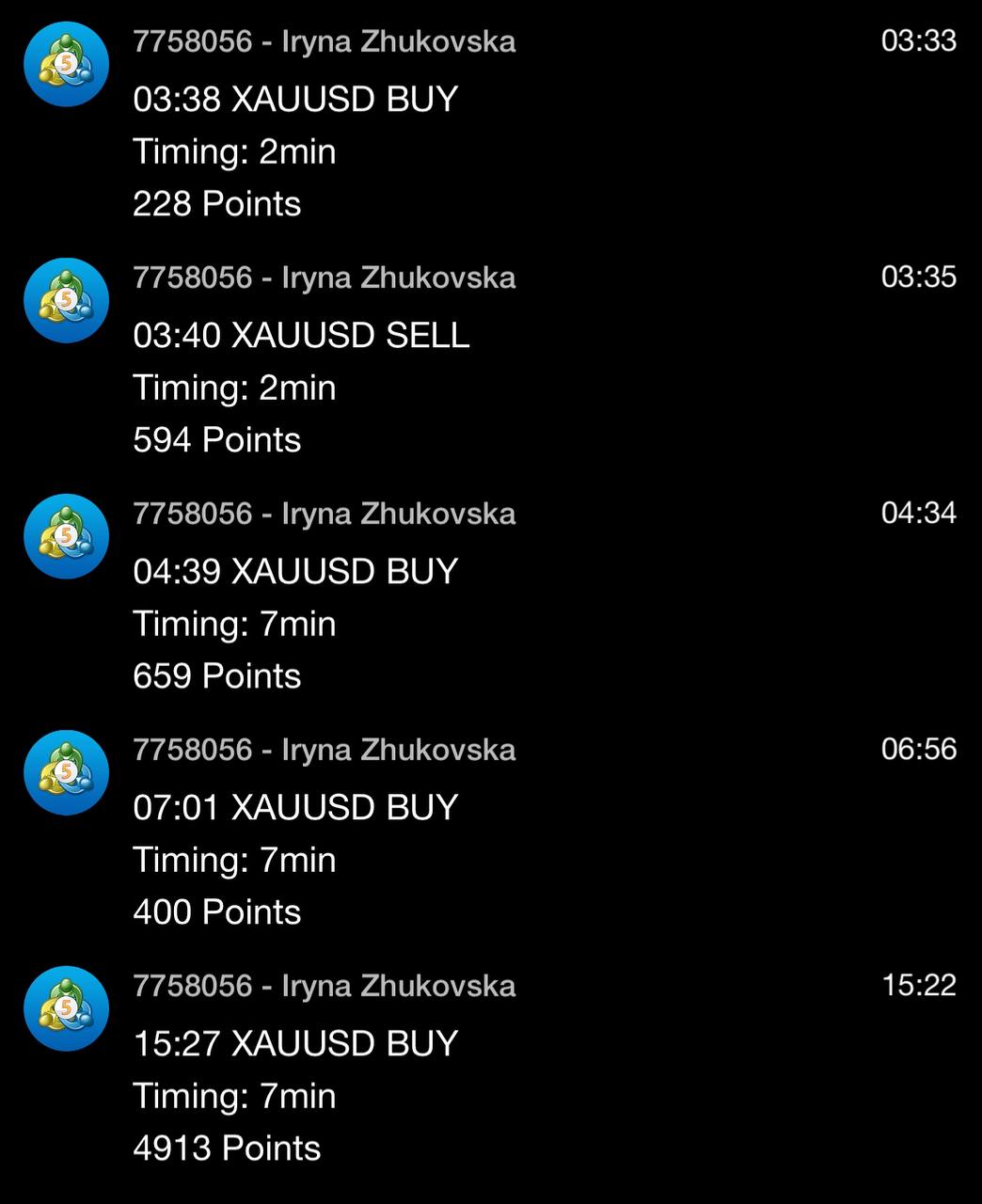

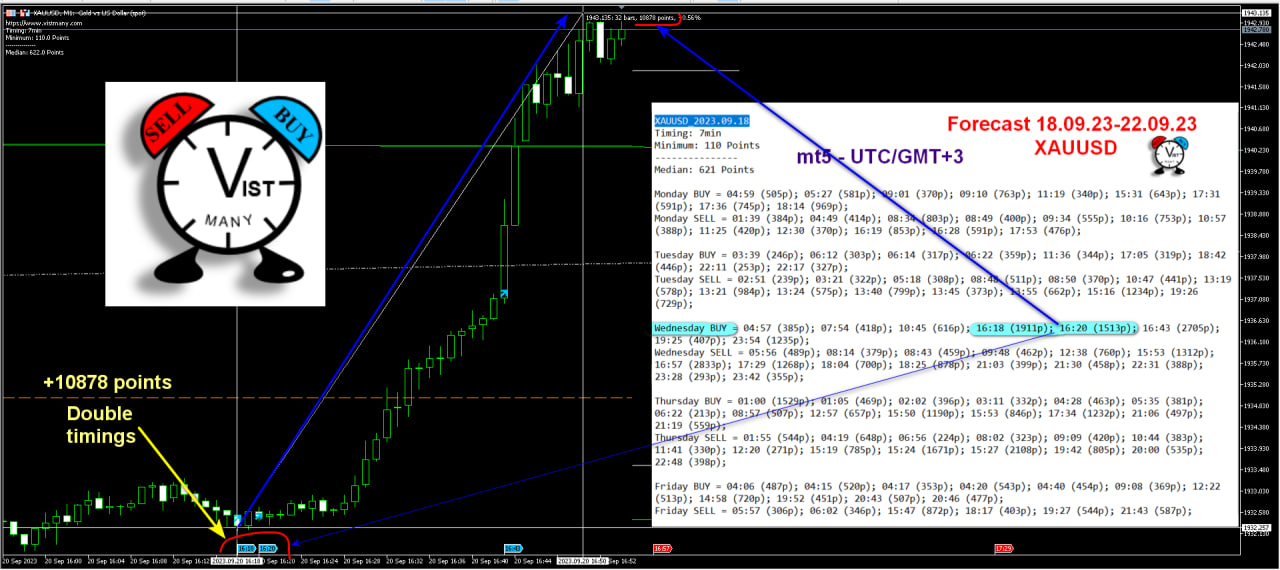

Double timings are a great tool for making a profit. Let's look at the double timings for the XAUUSD pair that were today. Even a novice trader will be able to work with them and make a profit. We need to adhere to the basic rules of our system. At the maximum of the daily and weekly channels, do not enter the buy and at the minimum, respectively, do not enter the sell. I remind you that double timings are very close in time. Their interval is from 2 to 6 minutes.

Good luck and profit to everyone! Before you start working on a real account, test double timings on other instruments. We recall a few more rules of the system. We are looking for the best entry using double timing. We look at the forecast of the system for each timing in points. Usually, timing works better, having a larger forecast for points. This is not always the case, but often. If the first timing of the pair worked, then we don't go into the second timing!

Good luck and profit to everyone! Before you start working on a real account, test double timings on other instruments. We recall a few more rules of the system. We are looking for the best entry using double timing. We look at the forecast of the system for each timing in points. Usually, timing works better, having a larger forecast for points. This is not always the case, but often. If the first timing of the pair worked, then we don't go into the second timing!

Double timing operation on the XAUUSD pair. Remember the rule of the system: if the first timing is in profit, we ignore the second timing. There are double timings on different instruments. It is comfortable to work with them. Test and apply in your strategy. Very often, double timings show an impulse towards the main movement of the instrument.

Timing spectra

First, let's figure out how to determine the trading weeks of the month. Each week is very individual for trading. It is necessary to take this fact into account and make the settings of the iVISTscalp5 indicator more effective.

Using the example of 2024, we will learn how to determine the week number of the month. The numbering of the week in the financial market is determined by the first Thursday of the month. For example, January. The first Thursday is January 4th. Therefore, from January 1 to January 7 is the first trading week of the month. We take into account Saturday and Sunday, as there is a cryptocurrency market.

Let's define the first week in the month of March. The first Thursday is March 7th. Therefore, from March 4 to March 10 is the first trading week of the month.

Why do we need to know such information? Firstly, according to statistics, the forecasts of our VISTmany system are most effective in the second and third weeks of the month (+95%). Secondly, we often write that Thursday and Friday in the third trading week of each month, trading according to timings (forecasts) is not recommended for novice traders. Now you know how to determine the week number of the month.

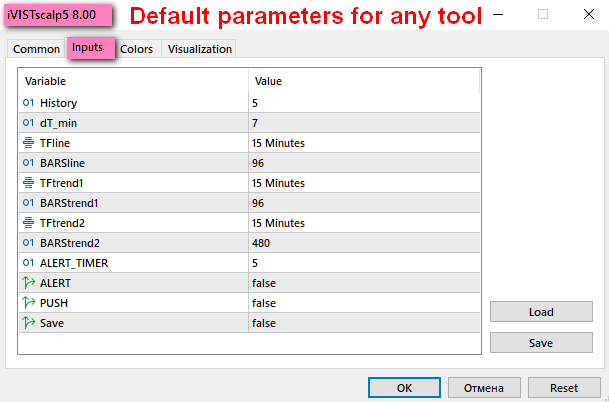

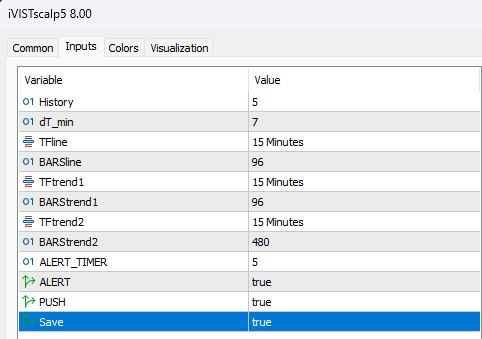

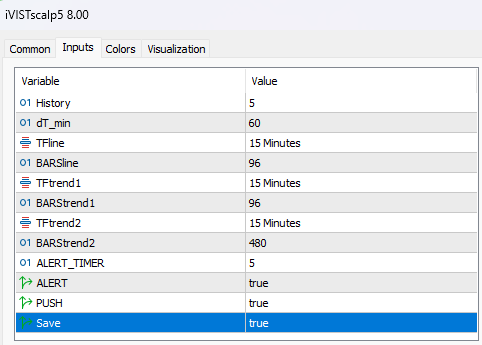

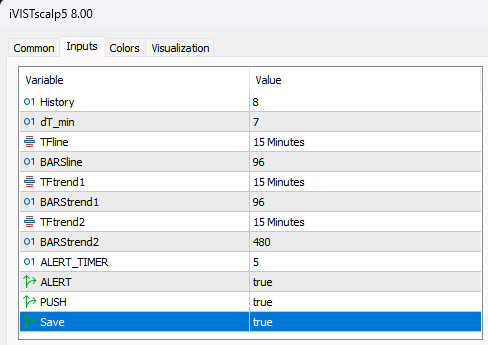

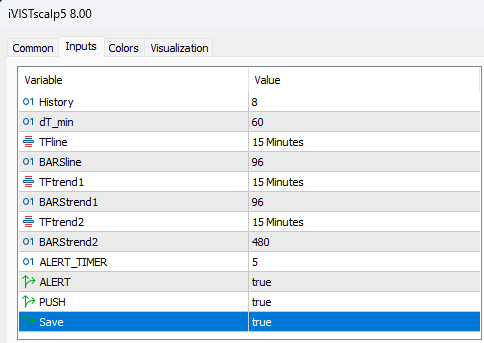

In the first and last week of the month, we must take into account the main price levels in the vicinity of the forecast timings (time levels). The main settings of the indicator are shown below. Be sure to follow our recommendations. All options for the indicator settings are suitable for any financial instrument.

iVISTscalp5 Indicator

iVISTscalp5 Indicator

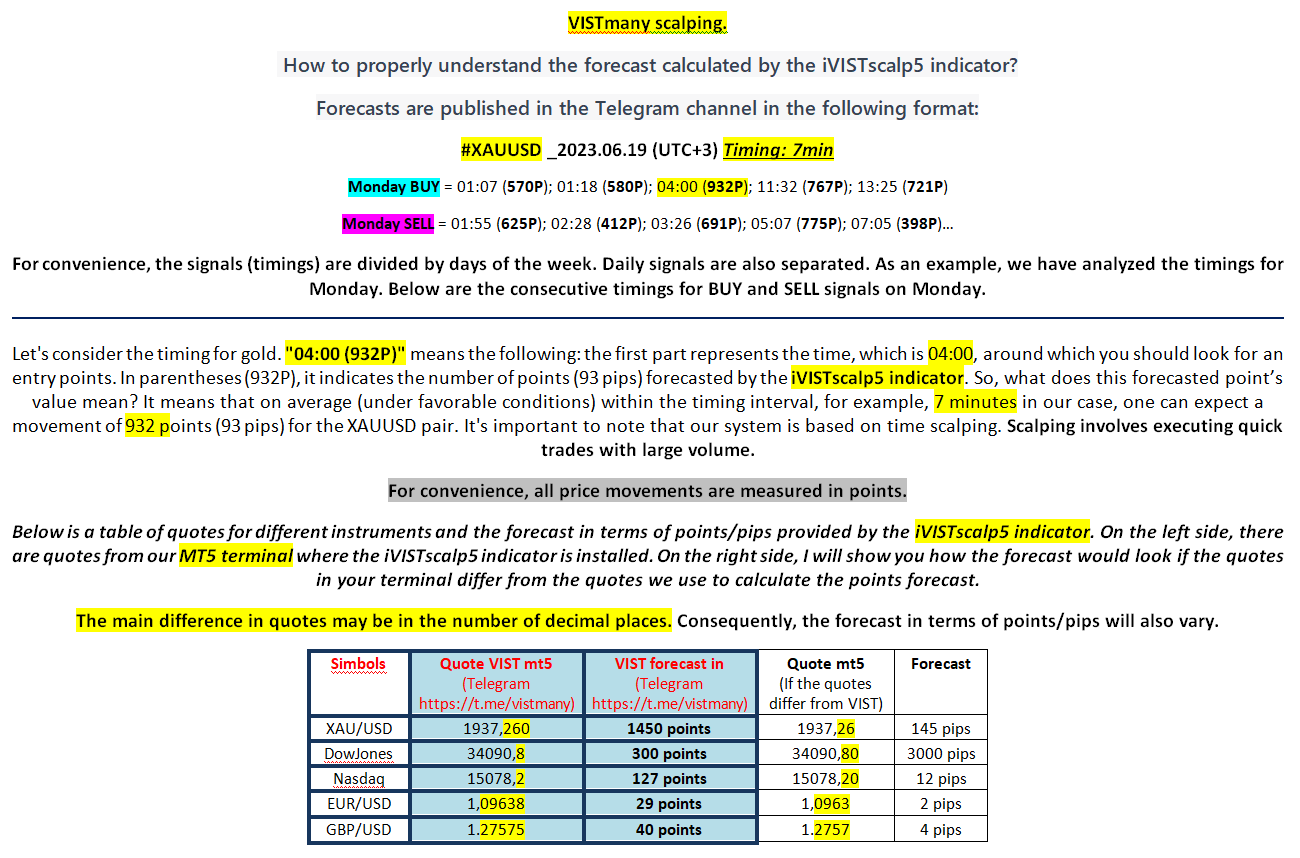

Timings is an innovative scalping system. From idea to implementation. Basic concepts of time levels (timings).